The Value of Installed Based Data in Achieving Revenue Growth: Highlights from Industry Research Study

Jul 18, 2022Background

Starting in the mid-1980s, Industrial OEMs like GE began to recognize that the service and support of their equipment, after the sale, could represent a sizeable profitable market opportunity. This recognition has led to a long-term trend where OEMs in a broad array of industrial segments are increasingly transitioning from product-centric companies to service-oriented firms. Despite several well-publicized success stories, the vast majority either struggle with achieving consistent revenue growth or find it challenging to capture what they estimate to be their fair share of their service addressable market.

Over three (3) months, we conducted market research among 93 industrial OEMs to understand their revenue growth and market share acquisition challenges. The respondents were representative of a broad array of businesses. Approximately two-thirds of companies (67%) are either OEMs (45%) or MSPs (22%). The other companies represented include Third-Party Maintenance (TPMs) providers, Contractors/Installers, and Utilities. Approximately three-fourths of companies (75%) had between $100 million and $5 billion in revenue for 2021. While a majority of companies (62%) have 1,000 or more employees. Our research, highlighted in this blog post, was gathered through quantitative and qualitative methods. The research findings also identify OEMs’ approaches to overcoming these challenges.

Multiple Sources of Data

An investigation of go-to-market and sales planning practices among industrial OEMs regarding revenue generation suggests a highly data-intensive process. Service providers can’t simply sell services to anyone based on the function these activities perform. Instead, OEM service organizations must possess a detailed and precise view of their install base to decide who to approach, what services to offer, when to offer them, and how to price them.

At issue, installed base (IB) data is often not readily available or attainable by OEM service sales and marketing personnel. According to our survey research, approximately two-thirds (67%) of companies indicate that critical and relevant IB data can be distributed between as many as three (3) to four (4) different enterprise systems or applications. For example, customer site information may be contained within the company’s CRM. At the same time, product shipment data could reside in the ERP system, parts sales information in the Supply Chain Management (SCM) system, and service contract information and equipment service history may be in the field service management system (FSM).

No Clear Ownership of Data

Further exasperating this situation is that there is no clear owner of IB data within industrial OEMs. Various functions are responsible for tracking and maintaining this data. These functions include but are not limited to sales, marketing, service, support, and finance. The net impact is that there is limited accountability within industrial OEMs concerning IB data management. In addition, nearly one-half (46%) of companies indicate that resources to support IB data management are not always available.

Given the situation within most OEM service organizations, it’s no wonder that the vast majority (90%) of companies surveyed find it somewhat, very, or extremely time-consuming to obtain relevant IB data and business intelligence necessary for increasing service revenue. In addition, over one-third (38%) are constrained by the length of time to implement IB management tools.

Limitations on Business Initiatives

Consequently, industrial OEMs do not have access to the full array of IB analytics necessary for making informed decisions concerning implementing sales and go-to-market strategies. Assessments are typically made based on a gut feeling, educated guess, or what has worked in the past rather than real-world data. Less than half of companies surveyed consider IB analytics that provides insight into customer buying behavior or sales opportunities such as targeted sales hunting lists, market segmentation analysis, or propensity to purchase parts and services.

These limitations negatively impact the ability of industrial OEMs to achieve their strategic goals and objectives concerning Key Performance Indicators (KPIs) related to service revenue growth and service addressable market penetration. It also underscores the need for a purpose-built business intelligence tool to provide a complete view of critical analytics related to an industrial OEM installed base. The vast majority (87%) of companies indicate they would consider investing in this tool over the next 12 months due to its perceived benefits. The key factors driving this decision are the value to their business, the amount of ROI, and the time to ROI.

An Optimal Solution

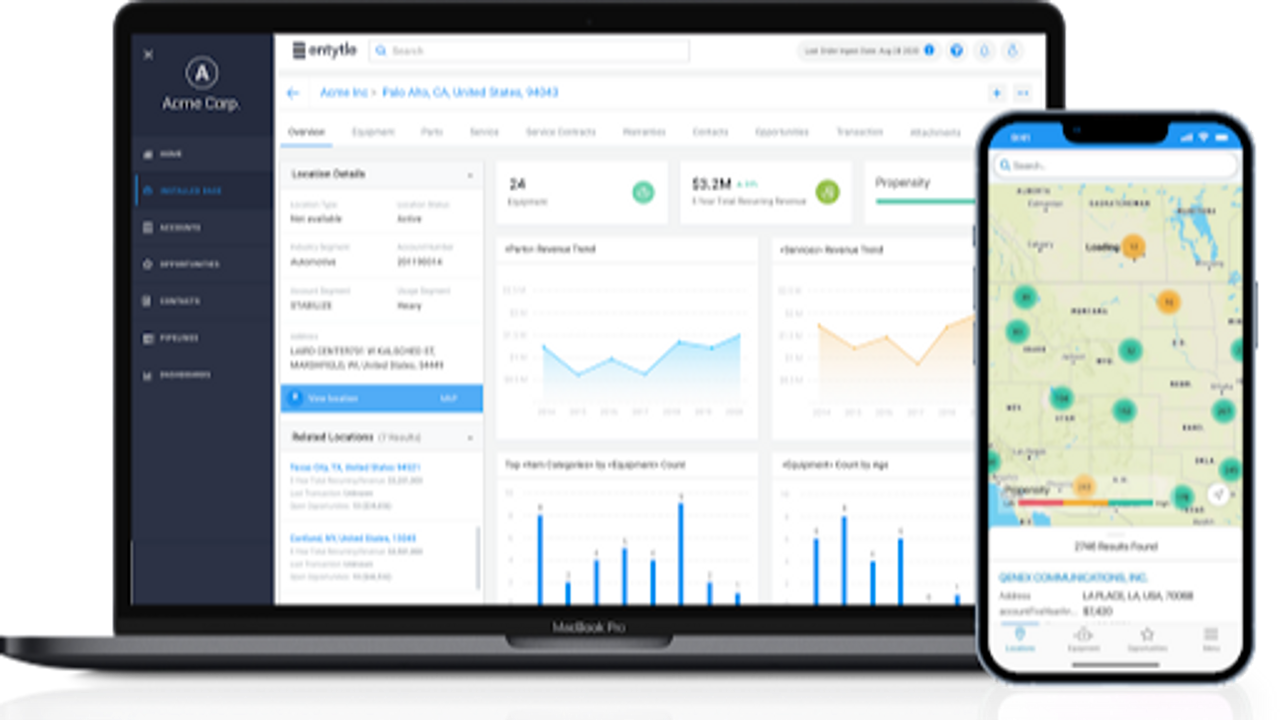

Our research findings highlight industrial OEMs’ challenges and difficulties in creating and analyzing IB data. As mentioned above, these limitations hamper companies' ability to obtain revenue goals and objectives. Companies interested in monetizing the total value of their installed base should consider implementing an Installed Based Platform, such as the solution provided by Entytle. An IBP enables OEMs to obtain richer business intelligence and deeper IB insights to increase revenue, boost profits, and deliver an exceptional customer experience.

Companies implementing Entytle’s IBP have realized numerous benefits relatively quickly post-implementation.

First, they have gained better visibility into IB data which empowers their sales and service personnel to deliver an exceptional customer experience and drive new revenue growth. Second, they’ve become more efficient and productive in generating BI reports and finding and closing new service revenue. Thirdly, they’ve generated a high ROI, as high as 10 X, within a relatively short time (e.g., 3 to 4 months). Given these findings, it is difficult to ignore the benefits of utilizing an Installed Base Platform, particularly for managing and selling into a large install base.

Download our whitepaper, titled Installed Base Platforms: An Emerging Technology to Maximize the Value of Installed Base Data, To learn more

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.